Sliding Brackets

Income tax brackets are considered a “sliding bracket”. Various portions of your income are taxed independently of each other. For example (rounded numbers used for simplicity), if you’re single, the first $10,000 of taxable income is taxed at 10% (the first tax bracket). The next income bracket is 12%. If you earned $11,000, not all of your income is taxed at 12%, only the amount of income over $10,000. The first $10,000 would be taxed at 10%, and the amount over that, $1,000, is taxed at 12%. This gives you a tax of $1,000 from the first bracket and $120 from the second bracket, for a total income tax of $1,120, not $1,200 as some people might think since you’re in the 12% tax bracket.

Standard/Itemized Deduction

When figuring out how much income tax you’ll be assessed, you first have to subtract your standard deduction amount ($12,200 single, $24,400 married filing jointly), or your itemized deduction amount, from your net income. (The standard and itemized deductions are separate from business deductions. You can read a little bit more about that here). Once you’ve done that, the leftover amount is what is subject to the different levels of tax brackets.

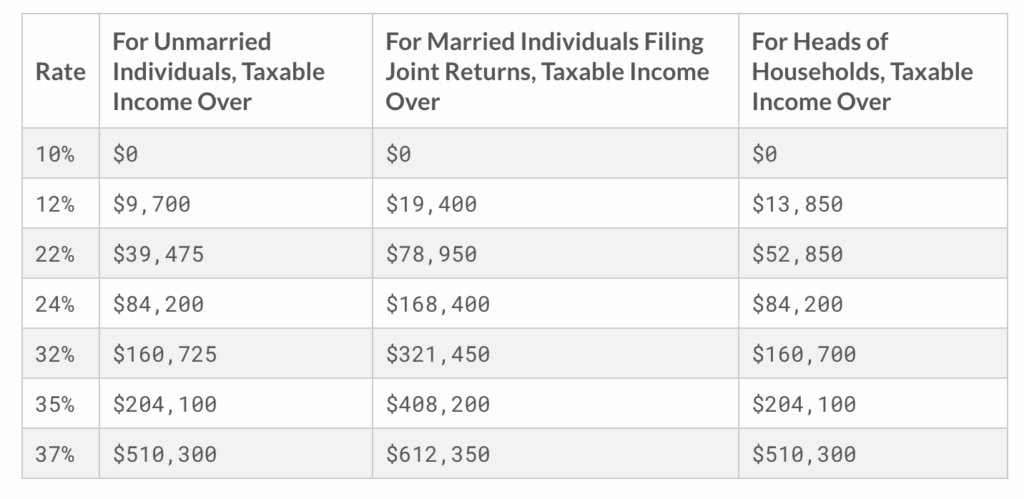

2019 Income Tax Brackets

From the IRS:

For tax year 2019, the top rate is 37 percent for individual single taxpayers with incomes greater than $510,300 ($612,350 for married couples filing jointly). The other rates are:

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2019

35 percent, for incomes over $204,100 ($408,200 for married couples filing jointly);

32 percent for incomes over $160,725 ($321,450 for married couples filing jointly);

24 percent for incomes over $84,200 ($168,400 for married couples filing jointly);

22 percent for incomes over $39,475 ($78,950 for married couples filing jointly);

12 percent for incomes over $9,700 ($19,400 for married couples filing jointly).

The lowest rate is 10 percent for incomes of single individuals with incomes of $9,700 or less ($19,400 for married couples filing jointly).

More simply put:

Still need a little help?

Digesting, figuring out, and applying self-employment tax and income tax can be a little bit confusing when trying to figure out what you will owe. For a more in-depth example, please feel free to check out our in-depth blog topic, The Nitty Gritty Tax Example with Calculations.

Contact Us

Looking for a highly skilled, credentialed, and all-together good-natured tax specialist? Email me at Chad@YourTaxPrep.com. I’m more than happy to offer consultation services if you need help figuring out your tax situation, if you have questions about retirement savings, or anything else under the broad “tax” topic.

Recent Comments