by Chad Mangum | Jun 9, 2019 | Tax Basics

This is probably one of the more anticipated questions, especially around tax season. What can you deduct as a business expense? Most of it is pretty easy and straight forward. But first, a few quick notes. Keep records of everything you want to...

by Chad Mangum | May 28, 2019 | Tax Basics

Self-employment Deduction Benefits One of the great benefits of being self-employed and working from home is the Home Office Deduction (video version here). To qualify for the home office deduction, your home office needs to be used exclusively on a regular...

by Chad Mangum | May 20, 2019 | Tax Basics

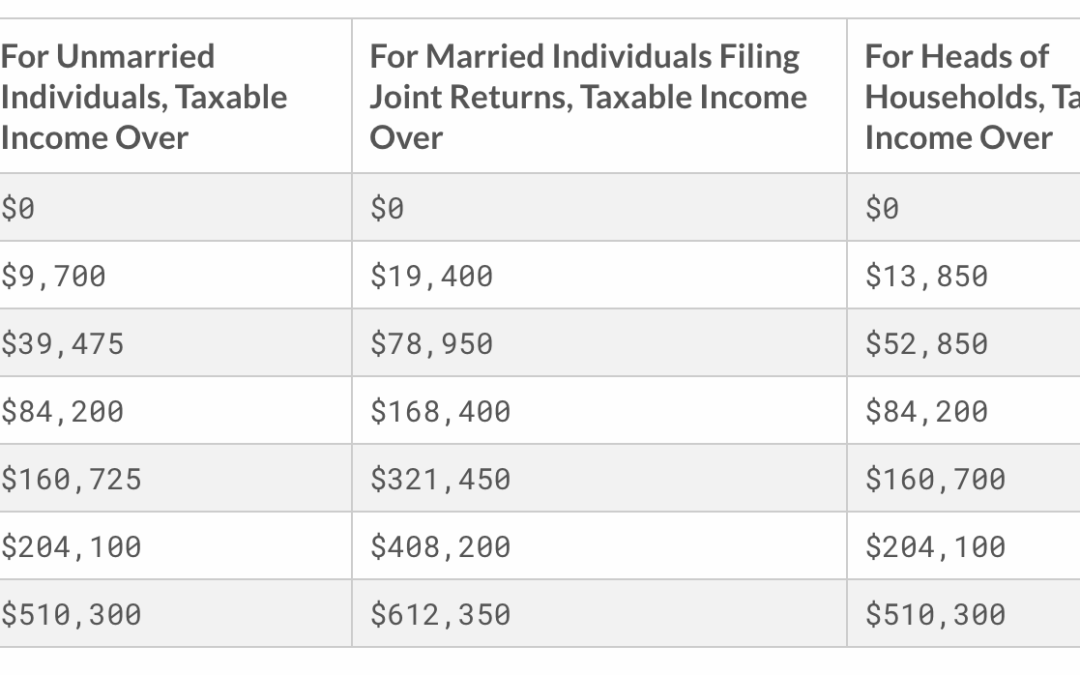

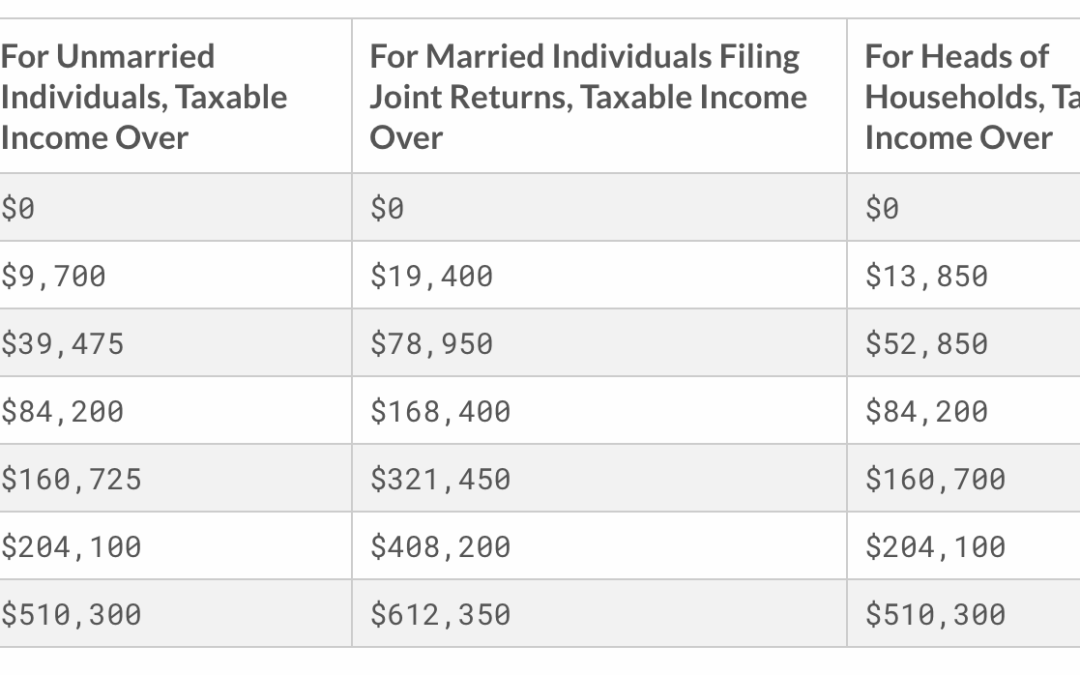

Income Tax Table You’ll need an income tax table to follow along with the examples. Here’s a very succinct version of the 2019 Income Tax Table used in the examples below. (The actual standard deduction used below is rounded for simplicity. The real values...

by Chad Mangum | May 20, 2019 | Tax Basics

Sliding Brackets Income tax brackets are considered a “sliding bracket”. Various portions of your income are taxed independently of each other. For example (rounded numbers used for simplicity), if you’re single, the first $10,000 of taxable income is...

by Chad Mangum | May 15, 2019 | Tax Basics

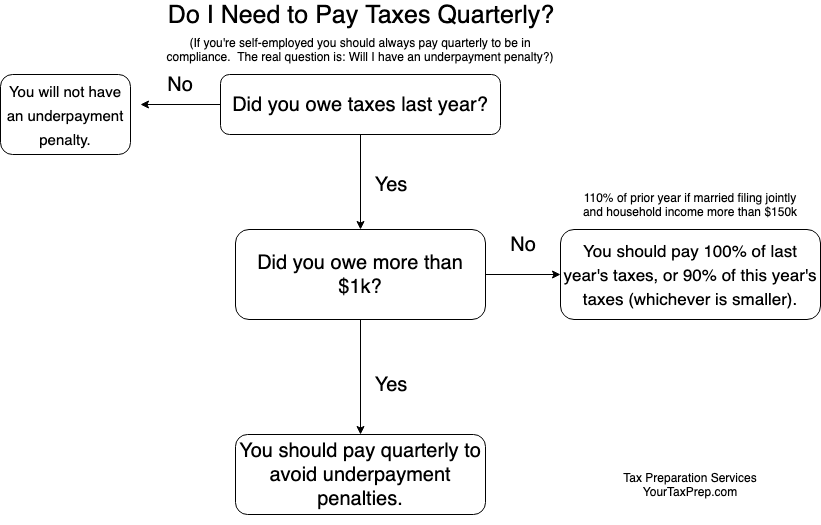

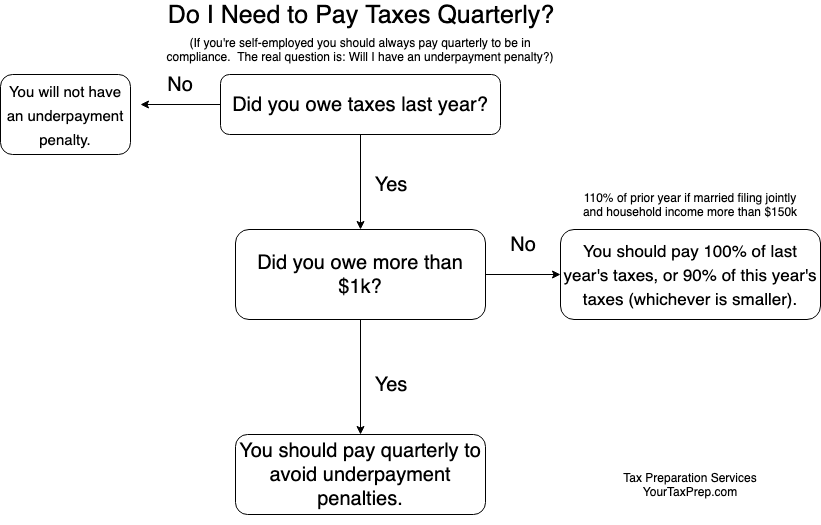

What are Estimated Quarterly Taxes? Taxes are a pay-as-you-go system. For people who are self-employed, the government requires taxes to be paid at least four times per year (thus “quarterly” taxes). Quarterly taxes include all taxes owed (income tax,...

by Chad Mangum | May 2, 2019 | Tax Basics

Advice If you’re an expat and looking for some tax advice and help, keep reading! Being overseas adds an extra layer of difficulty come tax time. We’re here to hopefully alleviate some of that burden for you. We’ll touch on a few key questions that...

Recent Comments