Our Tax Blog

A collection of our articles on various aspects of taxes. We cover Tax Representation subjects (collections, liens, levies, penalty abatement), individual tax situations, and business taxes.

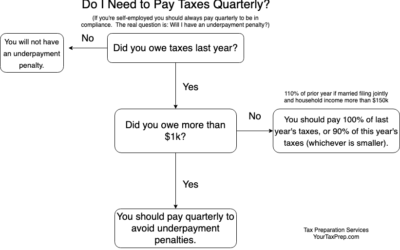

Paying Estimated Quarterly Taxes, 2019

What are Estimated Quarterly Taxes? Taxes are a pay-as-you-go system. For people who are self-employed, the government requires taxes to be paid at least four times per year (thus "quarterly" taxes). Quarterly taxes include all taxes owed (income tax, self-employment...

Tax Resolution in Salt Lake City, UT (or anywhere else!)

Tax Resolution What is Tax Resolution? Tax Resolution is the area of taxes where a credentialed tax specialist (like an Enrolled Agent) is able to represent you before the IRS to resolve your tax issues. Tax issues can be things such as collections, penalty abatement,...

Expats, Taxes, and S Corps

Advice If you're an expat and looking for some tax advice and help, keep reading! Being overseas adds an extra layer of difficulty come tax time. We're here to hopefully alleviate some of that burden for you. We'll touch on a few key questions that come up a lot....

Online Taxes and Vetting your Tax Preparer

All Tax Preparers are not Created Equal Just because a tax preparer doesn't have credentials, it doesn't mean they're incompetent or that you shouldn't use them. Likewise, just because a tax preparer does have credentials, it doesn't mean they're competent. So, how do...

Tax Return Preparation in Salt Lake City (SLC), UT

Welcome! We're glad you found us! We provide online tax preparation services and are based in Salt Lake City, UT. At Tax Preparation Services, we aim to provide top-notch service with unbeatable prices. Why choose us? We know that you have a lot of options and are...

What is an Enrolled Agent?

Enrolled Agent An Enrolled Agent is a person credentialed by the IRS. Through multiple comprehensive tax exams, they demonstrate their expertise in a wide range of tax matters. Some of those tax matters include individual taxes, small businesses, S-corps, C-corps,...

S Corps, Do I Need One?

What is an S Corp? An S corp is a type of corporation that is considered a pass-through entity. A pass-through entity means that you, personally, will be taxed on the income the business generates. Why would I want an S Corp? An S corp does have some tax benefits. It...

Tax Basics for the Self-Employed

Overview Whether you're new to the world of self-employment, or just looking for a quick tax refresher, this is the perfect place to be! For 2019, self-employment (SE) tax is 15.3%. SE tax is made up of Medicare tax (2.9%) and Social Security tax (12.4%). Normally,...

Contact Us

We’d love to hear from you! If you have questions about our pricing or services, please feel free to contact us through the website, or send us an email.

Recent Comments