Our Tax Blog

A collection of our articles on various aspects of taxes. We cover Tax Representation subjects (collections, liens, levies, penalty abatement), individual tax situations, and business taxes.

QUALIFIED OPPORTUNITY ZONE (INDIVIDUAL)

Leveraging Qualified Opportunity Zones for Strategic Investment and Tax Benefits Qualified Opportunity Zones (QOZs) offer small business owners a unique investment opportunity to defer and potentially reduce capital gains taxes while contributing to economic...

IRS GUIDELINES FOR C-CORPORATION

Navigating IRS Guidelines for C-Corporations: A Comprehensive Overview for Small Business Owners Understanding IRS guidelines is essential for small business owners operating as C-Corporations. This article provides a detailed overview of the key tax obligations,...

CHILD IRA

Building Future Wealth with the Child IRA Strategy The Child IRA strategy offers small business owners an effective way to build long-term savings for their children while gaining tax advantages. This article explores how hiring your children and contributing to their...

S Corps and Basic Tax Savings

I briefly discussed LLCs, S Corporations, and C Corporations in a previous article. In this article, I’ll expound more on S Corps, their basic operating principles, and demonstrate potential tax savings. The Inception of an S Corporation S Corps are an...

Self-employment Deductible Expenses

This is probably one of the more anticipated questions, especially around tax season. What can you deduct as a business expense? Most of it is pretty easy and straight forward. But first, a few quick notes. Keep...

The Difference Between the Actual and Simplified Methods for the Home Office Deduction

Self-employment Deduction Benefits One of the great benefits of being self-employed and working from home is the Home Office Deduction (video version here). To qualify for the home office deduction, your home office needs to be used exclusively on a regular...

The Nitty Gritty Tax Example with Calculations

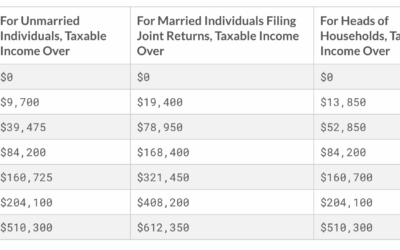

Income Tax Table You'll need an income tax table to follow along with the examples. Here's a very succinct version of the 2019 Income Tax Table used in the examples below. (The actual standard deduction used below is rounded for simplicity. The real values for 2019...

Understanding Income Tax Brackets and How They Work

Sliding Brackets Income tax brackets are considered a “sliding bracket”. Various portions of your income are taxed independently of each other. For example (rounded numbers used for simplicity), if you’re single, the first $10,000 of taxable income is...

Contact Us

We’d love to hear from you! If you have questions about our pricing or services, please feel free to contact us through the website, or send us an email.

Recent Comments