by Chad Mangum | May 28, 2019 | Tax Basics

Self-employment Deduction Benefits One of the great benefits of being self-employed and working from home is the Home Office Deduction (video version here). To qualify for the home office deduction, your home office needs to be used exclusively on a regular...

by Chad Mangum | May 20, 2019 | Tax Basics

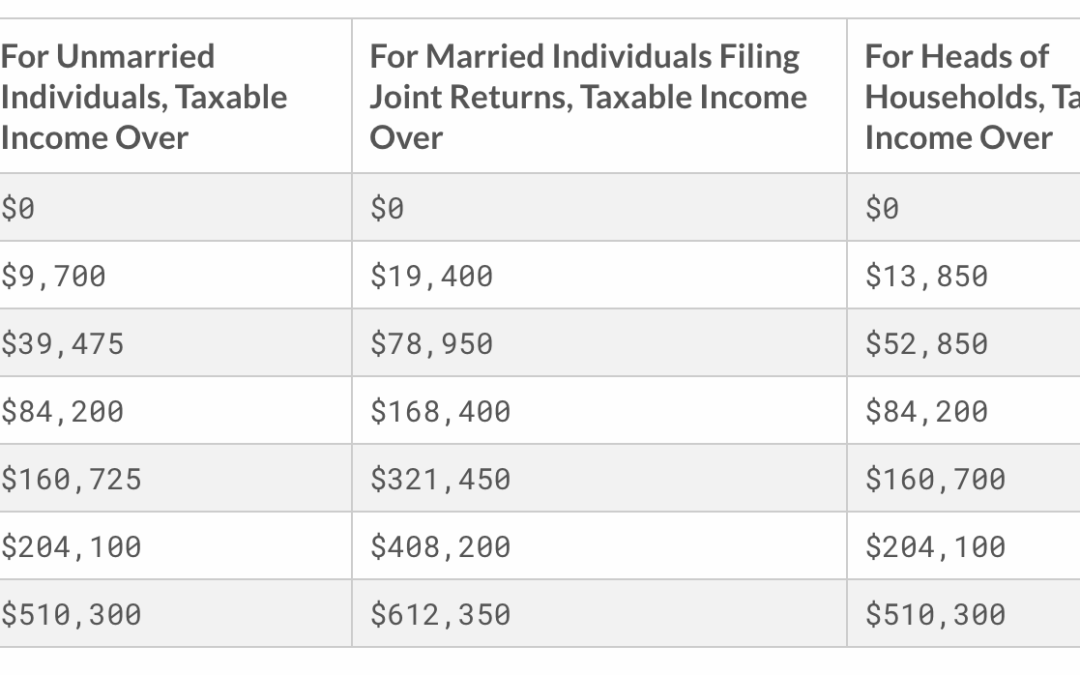

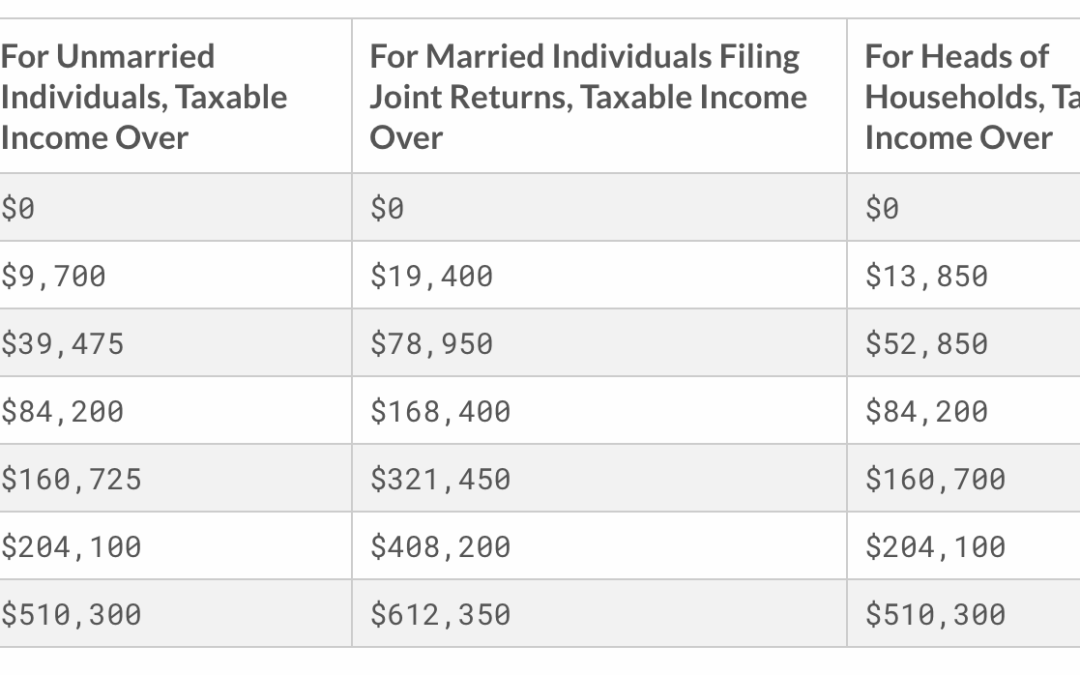

Income Tax Table You’ll need an income tax table to follow along with the examples. Here’s a very succinct version of the 2019 Income Tax Table used in the examples below. (The actual standard deduction used below is rounded for simplicity. The real values...

by Chad Mangum | May 20, 2019 | Tax Basics

Sliding Brackets Income tax brackets are considered a “sliding bracket”. Various portions of your income are taxed independently of each other. For example (rounded numbers used for simplicity), if you’re single, the first $10,000 of taxable income is...

by Chad Mangum | May 15, 2019 | Tax Basics

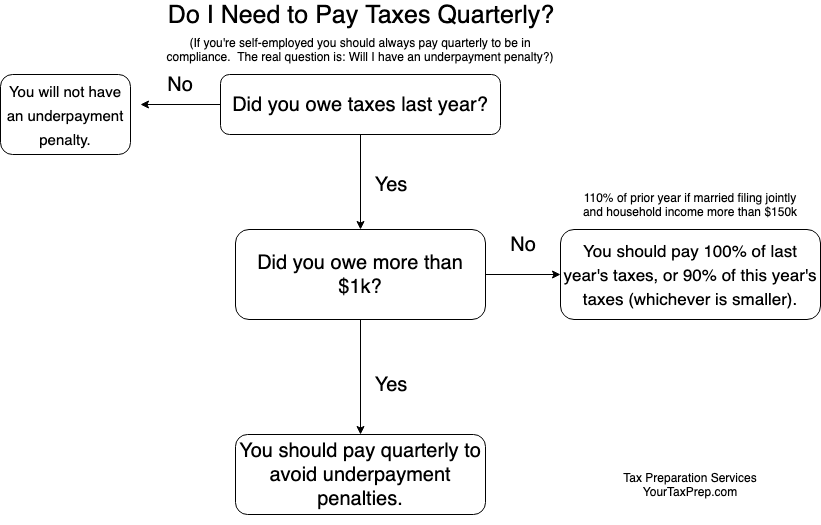

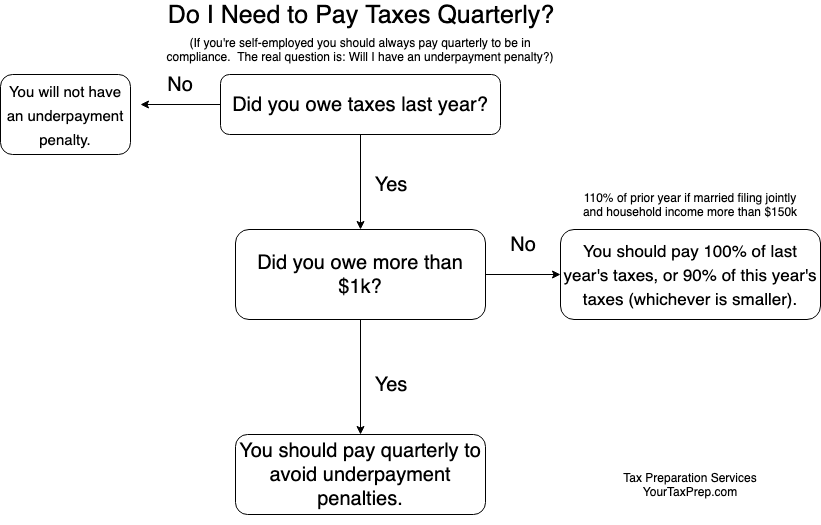

What are Estimated Quarterly Taxes? Taxes are a pay-as-you-go system. For people who are self-employed, the government requires taxes to be paid at least four times per year (thus “quarterly” taxes). Quarterly taxes include all taxes owed (income tax,...

by Chad Mangum | May 3, 2019 | Tax Resolution

Tax Resolution What is Tax Resolution? Tax Resolution is the area of taxes where a credentialed tax specialist (like an Enrolled Agent) is able to represent you before the IRS to resolve your tax issues. Tax issues can be things such as collections, penalty abatement,...

Recent Comments